The Patient Investor

Why Diversify When It Doesn't Seem To Be Working?

Over the last several decades, we’ve seen strong returns from large U.S. companies and a question that many clients have asked is: “Why continue to diversify? Couldn’t we just buy an S&P 500 index fund and get better returns?”

Over the last several decades, we’ve seen strong returns from large U.S. companies and a question that many clients have asked is: “Why continue to diversify? Couldn’t we just buy an S&P 500 index fund and get better returns?”

Dimensional Fund Advisors (DFA) recently posted a terrific blog entitled "A Tale of Two Decades: Lessons for Long-Term Investors" that shares some very insightful data that sheds some light on these important questions.

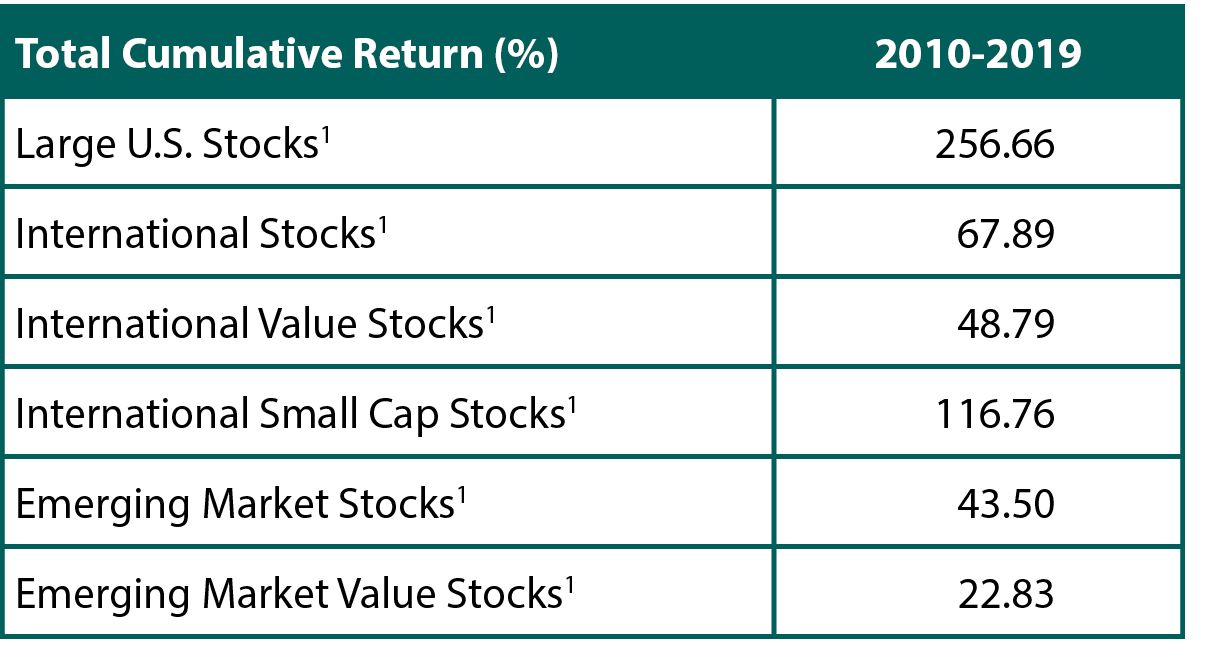

First, let's look at the numbers over the last decade ... in the chart below, you can see that the S&P 500 (U.S. large cap stocks) had a cumulative return from 2010-2019 that was more than double any of the other listed asset classes. Furthermore, some evidence-based investment managers we use (such as DFA), favor value ("cheap") stocks over growth ("expensive") stocks, as value stocks have been shown to provide excess returns over time. As you can see in the chart below, it wasn't a great decade for value stocks either as the indexes with a value-tilt trailed the market-cap indexes.

So why continue to diversify? Let's broaden our perspective and take a longer term view, looking at the prior decade of 2000-2009 as an example. That timeframe has been called the "lost decade" for U.S. investors for a good reason as large U.S. stocks had a negative total return, while other asset classes did better. If all your money was invested in an S&P 500 index fund over that time, you may have very well thrown in the towel at that point, deciding in your mind that U.S. stocks are a terrible investment.

So, how did these asset classes do over the 20 years combined? As you can see, every asset class did well, though during different periods. And interestingly enough, even though U.S. large cap stocks did great during the recent decade, they were in the middle of the pack when looking at 20 year cumulative returns.

So, is it time to abandon diversification and buy an S&P 500 index fund? Hopefully this research helps demonstrate why we believe diversification is as important (if not more important) than ever before. Will U.S. large cap stocks continue to outperform over the coming decade? Possibly, but no one knows what the futre holds. From a valuation perspective, a case could be made that asset classes like small-cap, international and value stocks may be primed for a period of relative outperformance over U.S. large-cap stocks.

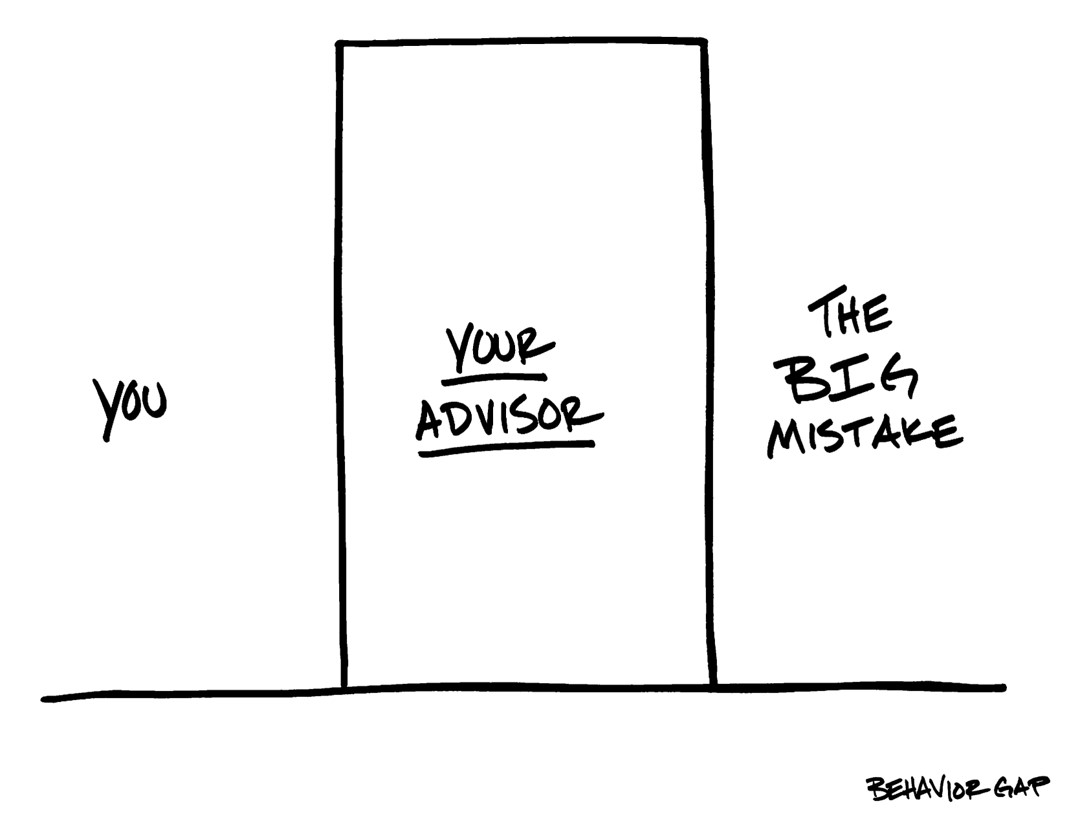

When investors try to outguess the market or bet on one area of the market, they typically get it wrong. We are wired to instinctively look for perceived patterns whether real or not (“pattern recognition” bias) and gravitate toward what’s done the best recently (“recency bias”). These behavioral biases can cause investors to chase hot trends, often right before the trend reverses.

Part of our job as advisors is to help clients maintain a longer-term perspective and make decisions that give them better odds of financial success over their lifetime. The good news is, you don’t need to pick winners or avoid losers to be successful. Owning all of the asset classes does work over time and help reduce the risk of making a big mistake. As Nobel Prize winner Harry Markovitz has famously said, “diversification is the only free lunch in finance.” We agree. You can learn more about how we approach diversification here: Smart Diversification.

Stay patient, my friends.

Additional Resources

- The Case for Global Diversification – Dimensional Fund Advisors

- Common Investor Mistakes

- Allodium Investment Committee

1 Dimensional Fund Advisors, Returns Web.

Indexes shown:

- Large U.S. stocks – S&P 500 Index

- International stocks - MSCI World ex USA Index (net dividends)

- International value stocks - MSCI World ex USA Value Index (net dividends)

- International small-cap stocks - MSCI World ex USA Small Cap Index (net dividends)

- Emerging market stocks - MSCI Emerging Markets Index (net dividends.)

- Emerging market value stocks - MSCI Emerging Markets Value Index (net dividends)

Learn more about Eric Hutchens

Hello! I’m Eric, the president and chief investment officer at Allodium Investment Consultants, located in Minneapolis, MN. I am dedicated to helping clients achieve their unique goals through designing tax-efficient investment strategies and comprehensive financial planning. In my spare time away from the office, I enjoy relaxing at my cabin in northwest Wisconsin with my wife, two sons, and two rescue dogs. I have also volunteered with my church, serving on the elder board and as a youth group leader.

The information provided is for educational purposes only and is not intended to be, and should not be construed as, investment, legal or tax advice. Allodium makes no warranties with regard to the information or results obtained by its use and disclaim any liability arising out of your use of or reliance on the information. It should not be construed as an offer, solicitation or recommendation to make an investment. The information is subject to change and, although based upon information that Allodium considers reliable, is not guaranteed as to accuracy or completeness. Past performance is not a guarantee or a predictor of future results of either the indices or any particular investment.