What Is Fiduciary Investment Advice and Why Does it Matter?

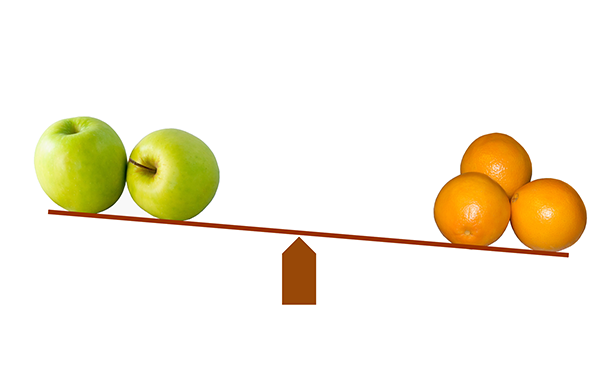

How do you know when an investment recommendation is worth heeding? Red tape and legal jargon aside, it’s about finding an advisor who exemplifies a few simple ideals:

“There’s no confusion in the minds of investors as to what they want. They’re very clear. They want somebody they trust who makes recommendations that put their interest first and don’t allow the advisor to profit financially at their expense.”

— Phyllis Borzi, Dept. of Labor EBSA head, 2009–2017

That makes sense, doesn’t it? There’s even a term the investment world has been using since at least the 1940s to describe this high standard. It’s called fiduciary advice.

Why Fiduciary Advice (Still) Matters

Fiduciary advice makes sense to us too. Investors deserve nothing less than the fairest possible shake from anyone entrusted with advising them about their personal wealth. For decades, the fiduciary standard has shaped this high level of care for those of us committed to delivering it.

Having a fiduciary duty to our clients puts us on similar footing with other professional consultants, such as physicians or attorneys. You hire us partly because we have dedicated our career to understanding every facet of your wealth. But you also hire us to always use our knowledge to advise you according to your highest financial interests – even ahead of our own.

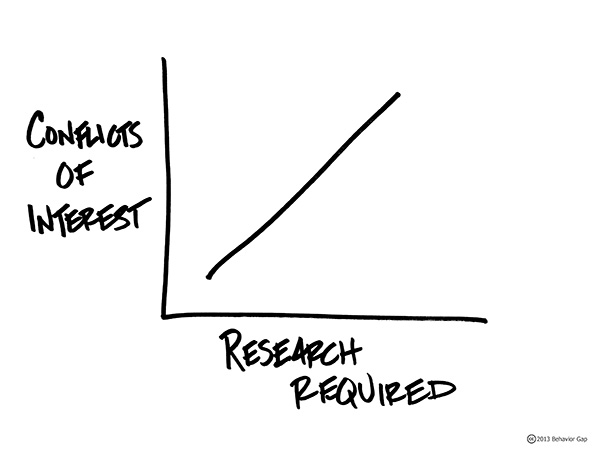

Unfortunately, the fiduciary standard has been under attack lately. A recent Securities and Exchange Commission (SEC) overhaul has downplayed rather than strengthened its significance by overlaying it with a new industry standard, paradoxically called “Regulation Best Interest.”